Here is an overview of ten widely recognized and influential currencies from around the world. Please note that economic conditions and currency values can change, so it’s essential to verify the latest information.

United States Dollar (USD):

The United States Dollar (USD) stands as the official currency of the United States and holds a preeminent position as one of the most widely used reserve currencies globally. Its widespread acceptance and utilization in international trade contribute significantly to its status as a key player in the global financial system. The U.S. Dollar serves as a benchmark for commodities, investments, and trade transactions across the world.

Name Origin:

The term “dollar” traces its etymological roots to the German word “Thaler,” which refers to a silver coin that gained broad circulation in Europe during the 16th century. The Thaler, originally minted in the town of Joachimsthal (now Jáchymov in the Czech Republic), became a common currency in various European countries.

The adoption of the dollar as the official currency of the United States occurred in 1792 with the passage of the Coinage Act. The term “dollar” was chosen to reflect the widespread use and familiarity of the Thaler among the early American colonists. The Coinage Act established the U.S. Mint and introduced the decimal system for currency, making the dollar the foundational unit of American currency.

The U.S. Dollar’s association with the Thaler highlights the historical and economic connections between Europe and the United States. This choice of nomenclature was not merely linguistic but also symbolic, representing a nod to the economic and trade relationships that shaped the young nation.

Over the years, the U.S. Dollar has evolved into a symbol of economic stability and financial strength. Its resilience during times of global economic uncertainty has contributed to its status as a safe-haven currency, sought after by investors and central banks alike. The “dollar” has become synonymous with a reliable medium of exchange, a store of value, and a unit of account in the international financial arena.

In conclusion, the United States Dollar, with its roots in the Thaler and a rich history dating back to the founding years of the United States, plays a pivotal role in shaping global economic interactions. Its name not only reflects historical ties but also signifies the economic influence and stability that the currency represents on the international stage.

Euro (EUR):

The Euro, denoted by the symbol EUR, stands as the official currency of the Eurozone, a monetary union comprising 19 out of the 27 European Union (EU) member states. The Eurozone represents a significant economic and political collaboration, and the Euro serves as a tangible manifestation of the region’s commitment to shared monetary policies and economic integration.

The adoption of the Euro was a landmark step in the pursuit of a more closely integrated European economy. It facilitates seamless financial transactions and promotes economic stability within the Eurozone. The Euro’s introduction on January 1, 1999, as an electronic currency for banking and electronic transactions, was followed by the issuance of Euro banknotes and coins on January 1, 2002, marking the full transition to physical currency.

Name Origin:

The name “euro” has its origin in a public contest held to determine a suitable and symbolic moniker for the new European currency. The contest, conducted in 1995, invited citizens from across the participating countries to propose names and offer justifications for their choices. The ultimate selection of the name “euro” was based on its resonance with the shared ideals of unity and integration that underpin the European project.

The term “euro” is a singular form that works seamlessly across multiple languages, emphasizing inclusivity and cohesion. Its adoption transcends linguistic boundaries, embodying the diversity of the Eurozone member states while promoting a sense of common identity. The choice of a single, unifying name reflects the broader aspirations of the European Union to foster collaboration and mutual understanding among its diverse member nations.

Symbolizing both the historical significance and the forward-looking vision of a united Europe, the name “euro” encapsulates the overarching goal of the Eurozone: to create a common economic space that fosters prosperity, stability, and cooperation. As the Euro continues to play a pivotal role in international finance and trade, its name serves as a constant reminder of the shared journey toward integration and solidarity among the nations of the European Union.

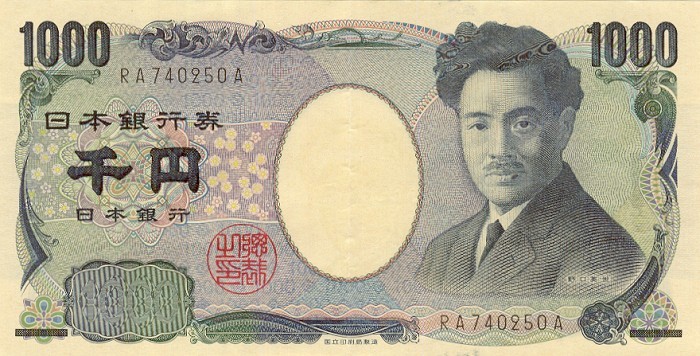

Japanese Yen (JPY):

The Japanese Yen, represented by the symbol ¥ and the code JPY, holds the distinction of being the official currency of Japan. Renowned for its stability and global significance, the yen has earned its place not only as a primary medium of exchange within Japan but also as a widely utilized reserve currency on the international stage.

Japan’s economic prowess and technological advancements have contributed to the yen’s standing as a key player in global finance. Its role as a reserve currency means that central banks and financial institutions worldwide hold significant reserves in Japanese yen, underscoring its importance in the global monetary system.

Name Origin:

The term “yen” finds its roots in the Japanese language, where it means “round” or “circle.” This nomenclature can be traced back to the circular shape of traditional Japanese coins. The yen’s name reflects not only the physical characteristics of the currency but also carries cultural and symbolic connotations.

The adoption of the term “yen” aligns with the historical evolution of Japan’s currency. Before the yen, various types of mon (coins) were in circulation. The Meiji government, during the Meiji Restoration in the late 19th century, initiated currency reforms, leading to the establishment of the yen as the official currency in 1871.

The concept of “roundness” in the name not only describes the physical shape of the coins but also symbolizes completeness and unity. It reflects a cultural inclination towards harmony, an essential aspect of Japanese aesthetics and philosophy.

As a testament to its resilience and stability, the Japanese yen has weathered economic challenges and fluctuations, maintaining its status as a reliable currency in the global financial landscape. The circular motif embedded in its name serves as a reminder of the currency’s historical roots, while its contemporary significance underscores its role as a cornerstone in international finance and trade. The Japanese yen’s enduring presence continues to shape and contribute to the interconnectedness of the global economy.

British Pound Sterling (GBP):

The British Pound Sterling (GBP), commonly known as the pound, holds the distinction of being the official currency of the United Kingdom, encompassing England, Scotland, Wales, and Northern Ireland, as well as several British territories. Renowned for its historical significance and enduring presence, the pound sterling is a symbol of the economic strength and stability of the United Kingdom.

The pound plays a pivotal role not only within the United Kingdom but also on the global stage, being one of the oldest and most widely traded currencies. Its longevity and widespread use in international trade contribute to its status as a key reserve currency.

Name Origin:

The term “pound” has its etymological roots in the Latin word “libra,” which referred to a unit of weight. The use of “pound” as a monetary term dates back to medieval England when the currency’s value was equivalent to a pound of silver. This historical association with weight underscores the tangible and intrinsic value of the currency.

The additional descriptor, “sterling,” has origins in Old Norman French, where it signifies high quality or excellence. The term was initially used to differentiate the pound from other forms of currency circulating in medieval England. Over time, “sterling” became an integral part of the currency’s name, emphasizing the reliability and quality of the coinage.

The combination of “pound” and “sterling” not only denotes the unit of currency but also conveys a sense of historical continuity and the enduring commitment to excellence in monetary matters. The use of Latin and Norman French in the naming reflects the linguistic influences that have shaped the English language over centuries, showcasing the rich tapestry of the United Kingdom’s cultural and historical heritage.

As a testament to its resilience, the British Pound Sterling has weathered economic challenges and changes, maintaining its status as a symbol of economic stability and financial integrity. The fusion of historical roots and linguistic nuances in its name encapsulates the currency’s storied past and its ongoing significance in the contemporary financial landscape.

Swiss Franc (CHF):

The Swiss Franc (CHF) stands as the official currency of both Switzerland and Liechtenstein, two countries known for their economic stability, neutrality, and picturesque landscapes. The Swiss Franc holds a unique position in the world of currencies, prized for its historical resilience and the strong financial institutions that underpin it.

As the preferred medium of exchange in these Alpine nations, the Swiss Franc is recognized for its role in supporting robust financial systems, promoting economic confidence, and reflecting the disciplined approach to fiscal management embraced by Switzerland and Liechtenstein.

Name Origin:

The term “franc” finds its linguistic roots in the Latin word “Francorum,” which translates to “of the Franks.” The Franks were a West Germanic people who played a significant role in the early medieval history of Europe. The adoption of the name “franc” for the currency reflects historical ties to the broader European context.

Switzerland, with its multilingual population, demonstrates linguistic diversity in the nomenclature of its currency. The variations in the currency’s name across different regions of Switzerland showcase the coexistence of multiple official languages, including German, French, Italian, and Romansh.

– In German-speaking regions, the Swiss Franc is known as “Franken.”

– In French-speaking areas, it is referred to as “Franc suisse.”

– In Italian-speaking communities, the term used is “Franco svizzero.”

– In Romansh, the fourth official language, it is called “Franc svizzer.”

This multilingual nomenclature underscores Switzerland’s commitment to linguistic diversity and inclusivity within its borders. It is a testament to the country’s ability to harmonize different linguistic and cultural elements into a cohesive national identity.

The Swiss Franc’s value is not only measured in its financial strength but also in its representation of a nation that values unity amidst diversity. The historical and linguistic elements embedded in the currency’s name reflect Switzerland’s rich heritage and its ongoing commitment to stability and inclusiveness in the heart of Europe.

Canadian Dollar (CAD):

The Canadian Dollar (CAD), often symbolized by the dollar sign ($) and referred to colloquially as the “loonie,” serves as the official currency of Canada. As a vital component of the nation’s economic identity, the Canadian Dollar plays a pivotal role in both domestic and international trade, reflecting Canada’s economic strength and stability.

Name Origin:

The nomenclature “dollar” for the Canadian currency traces its historical roots to the Thaler, a silver coin widely circulated in Europe during the 16th century. The term “Thaler” morphed into “dollar” over time, becoming a common name for various currencies, including the U.S. Dollar. Canada, like its southern neighbor, adopted the term “dollar” to denote its official currency.

The Canadian Dollar officially assumed its role as the national currency in 1858. During this period, the Province of Canada, a precursor to the modern nation, faced economic challenges, including a shortage of British coins. In response, the authorities of the Province of Canada decided to introduce a new currency system, and the Canadian dollar was born.

While the name “dollar” may share historical ties with various currencies globally, its adoption in Canada aligns with the economic and trade relationships prevalent during the mid-19th century. This choice of nomenclature reflects Canada’s acknowledgment of its economic ties with other nations and its participation in the broader global financial system.

Over time, the Canadian Dollar has become a symbol of the country’s economic resilience and resource wealth. The addition of distinctive features, such as the iconic image of a common loon on the one-dollar coin (hence the term “loonie”), further emphasizes the unique Canadian identity embedded in its currency.

The Canadian Dollar’s journey from its historical roots to its contemporary significance mirrors Canada’s evolution as a modern and prosperous nation. Its stability and global recognition make it a valuable instrument in international trade and investment, while its name carries echoes of a shared economic history that transcends national borders.

Australian Dollar (AUD):

The Australian Dollar (AUD) is the official currency of Australia, as well as several of its territories and certain Pacific Island nations. Introduced in 1966, the Australian Dollar replaced the pound sterling as the country’s official currency when Australia decimalized its monetary system.

The decision to adopt the term “dollar” was part of the broader move towards decimalization, which aimed to simplify the currency system by dividing it into smaller units based on powers of 10. The Australian Dollar is abbreviated as AUD and is symbolized by the “$” sign, similar to several other dollar-denominated currencies around the world.

As one of the most widely traded currencies globally, the Australian Dollar plays a significant role in the international financial markets. Its value is influenced by various factors, including economic indicators, interest rates, trade balances, and geopolitical events. The Reserve Bank of Australia (RBA) is the country’s central bank responsible for issuing and regulating the Australian Dollar.

The Australian Dollar is commonly subdivided into smaller units, with coins and banknotes representing different denominations. Coins are issued in values of 5, 10, 20, 50 cents, and 1 and 2 dollars, while banknotes come in denominations of 5, 10, 20, 50, and 100 dollars.

Australia’s vibrant and stable economy, coupled with its rich natural resources, contributes to the Australian Dollar’s strength and attractiveness in the global financial landscape. Investors, traders, and tourists often use the Australian Dollar in transactions, both domestically and internationally.

Chinese Yuan Renminbi (CNY):

The Chinese Yuan Renminbi (CNY) is the official currency of the People’s Republic of China. It serves as the legal tender for all transactions within the country. The term “yuan” has deep historical roots, having been used as a unit of currency in China for centuries.

The name “yuan” (元) has its origins in Chinese history, where it historically referred to a round object, such as a coin. Over time, it became synonymous with money or currency. The Renminbi (RMB) is the official name for the currency, and it translates to “People’s Currency” in English.

The currency is issued and regulated by the People’s Bank of China (PBOC), which is the country’s central bank. The yuan is represented by the symbol “¥” and is commonly abbreviated as CNY in international financial transactions.

Chinese banknotes and coins are denominated in yuan, with commonly used denominations including 1, 5, 10, 20, 50, and 100 yuan for banknotes, and 1 yuan, and smaller denominations for coins. Larger denominations, such as 200 yuan and 500 yuan banknotes, are also in circulation.

The Chinese Yuan Renminbi is a significant player in the global economy. It has gradually internationalized, and China has taken steps to make it more widely used in international trade and finance. The exchange rate of the yuan is influenced by various factors, including China’s economic indicators, monetary policy, and global economic conditions.

As of my knowledge cutoff in January 2022, the internationalization of the yuan has been an ongoing process, with the currency being included in the basket of currencies that make up the International Monetary Fund’s (IMF) Special Drawing Rights (SDR), reflecting its importance in the global monetary system.

Indian Rupee (INR):

The Indian Rupee (INR) is the official currency of India, serving as the legal tender for transactions within the country. The term “rupee” has its linguistic roots in Sanskrit, specifically from the word “rupya,” which translates to “a coin of silver.”

The history of the rupee can be traced back to ancient times when silver coins were used as a medium of exchange in the Indian subcontinent. Over the centuries, various rulers and empires minted their versions of the rupee, contributing to its rich historical significance.

The Indian government, through the Reserve Bank of India (RBI), is responsible for issuing and regulating the Indian Rupee. The symbol for the Indian Rupee is “₹,” and it is commonly abbreviated as INR in international financial transactions.

Indian banknotes and coins come in various denominations. Commonly used banknote denominations include 10, 20, 50, 100, 200, 500, and 2000 rupees, while coin denominations include 1, 2, 5, and 10 rupees, as well as smaller denominations like 50 paise.

The value of the Indian Rupee is influenced by factors such as India’s economic conditions, inflation rates, trade balances, and global economic trends. Exchange rates with other currencies fluctuate based on these factors.

India’s economy is diverse and rapidly growing, contributing to the significance of the Indian Rupee in international trade and finance. The currency is widely accepted in financial transactions both within the country and in certain international markets.

South African Rand (ZAR):

The South African Rand (ZAR) is the official currency of South Africa, serving as the legal tender for transactions within the country. The term “rand” finds its origins in the Witwatersrand, a ridge in South Africa where extensive gold deposits were discovered in the late 19th century.

The Witwatersrand, often referred to simply as the Rand, is a region in Gauteng Province that played a pivotal role in the country’s economic development due to the significant gold reserves found there. The decision to name the currency after this region reflects the historical importance of gold mining in South Africa.

The South African Reserve Bank (SARB) is responsible for issuing and regulating the South African Rand. The symbol for the rand is “R,” and it is often denoted as ZAR in international financial transactions.

South African banknotes and coins come in various denominations. Banknote denominations include 10, 20, 50, 100, and 200 rand, while coin denominations include 1, 2, 5, and 10 rand, as well as smaller denominations like 1, 2, 5, 10, 20, and 50 cents.

The value of the South African Rand is influenced by various factors, including the country’s economic performance, inflation rates, interest rates, and global economic conditions. The rand has experienced fluctuations over time, and its exchange rate with other currencies can be impacted by both domestic and international economic developments.

As one of the most traded currencies in Africa, the South African Rand plays a crucial role in regional and international trade and finance. It is widely accepted in South Africa for both domestic and commercial transactions.

Future Considerations:

Currency values and economic dynamics are subject to change based on geopolitical events, economic policies, and global market conditions. Factors such as technological advancements, changes in international trade patterns, and monetary policy decisions will play crucial roles in shaping the future of these currencies. Additionally, the rise of digital currencies and advancements in financial technology may introduce new elements to the global monetary landscape. It’s essential to stay updated on economic trends and policy developments for a comprehensive understanding of the future trajectory of these currencies.